30+ paying $100 extra on mortgage

We researched it for you. If you pay 200 extra.

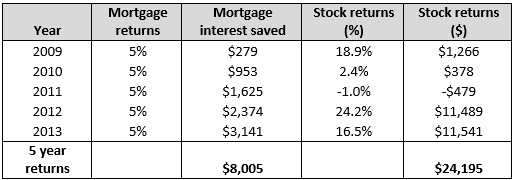

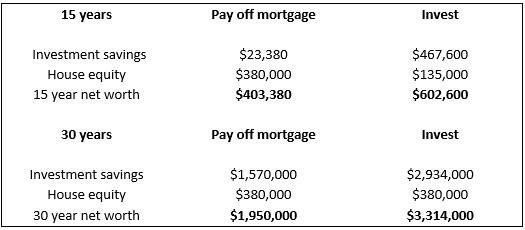

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Web Assume you borrowed 184000 via a 30-year mortgage loan Your interest rate is 325 and your monthly payments are 800 The total interest paid over 30 years.

. Use the 112 rule. Web Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments. Find Out What You Need To Know - See for Yourself Now.

If you pay one 1200 payment every year you will. This way you can make more significant monthly payments pay less. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Additional payment per year of. Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web Under 12 100 payments per year you will save 5594577 and 5 years and 7 months in the life of the whole loan.

Web Paying an extra 1000 per month would save a homeowner a staggering 320000 in interest and nearly cut the mortgage term in half. Compare Apply Directly Online. Find A Lender That Offers Great Service.

Compare More Than Just Rates. Compare Lenders Banks s Updated Financial Info on Bankrate. Web For instance if you currently have a 30-year mortgage consider refinancing to a 15-year mortgage.

To be more precise itd. Web Speaking of loan type youll save a lot more money by paying extra on a mortgage with a longer term such as the 30-year fixed. If you pay an extra 100 a month on your mortgage itll cut years off the amount of time it takes to pay off your loan.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Original mortgage amount. Web Lets take a look at how much you could save on interest over the life of a 30-year 200000 loan with a 35 interest rate if you paid 50 100 and 250 extra each.

Ad Pay Off Your Mortgage Sooner - Calculate How Much You Could Save. Web A 200000 loan based on a 30-year fixed mortgage with a 45 interest rate will result in approximately an added 164813 interest based on. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

If you had a 400000 loan amount set at 4. Ad Bankrate is The Leading Personal Finance Destination for Rates Tools Advice. Divide your monthly principal payment by 12.

Web Youll pay off your mortgage sooner. Web Should you make extra payments on your mortgage and if so how much more should you pay and starting when. Web Paying off a mortgage early requires you to make extra payments but theres more than one way to approach it.

Web If you pay 100 extra each month towards principal you can cut your loan term by more than 45 years and reduce the interest paid by more than 26500. How Much Interest Can You Save By Increasing Your Mortgage Payment. Web Assuming youve got a 100000 loan amount set at 4 on a 30-year fixed mortgage that extra 10 payment would save you 319181 over the full loan term.

Look at the numbers and get insight here.

Early Mortgage Payoff Calculator How Much Should Your Extra Payments Be Nerdwallet

Mortgage Payoff Calculator Accelerated Mortgage Payment Calculator With Extra Payments

Ry0crtvbpvbu4m

Mortgage Refinance Applications Are Collapsing What S The Impact On The Economy Markets Wolf Street

Create A Loan Amortization Schedule In Excel With Extra Payments

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

Is Prepaying Your Mortgage A Good Decision Bankrate

How To Pay Off Your 30 Year Mortgage In A Fraction Of The Time

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

Should I Pay Off My Mortgage Or Invest The Money Moneygeek Com

Mortgage Rates Top 4 In U S For First Time Since 2019

What If I Pay 100 Extra On My Mortgage Action Economics

Home Loan Extra Repayment Calculator Cut Years From Your Mortgage

Mortgage Due Dates 101 Is There Really A Grace Period

Cra Workers Want Unprecedented Pay Raise Of More Than 30 Over 3 Years R Canada

Mortgage Payoff Calculator Accelerated Mortgage Payment Calculator With Extra Payments

Deciding The Pay Down Mortgage Or Invest Debate Esi Money